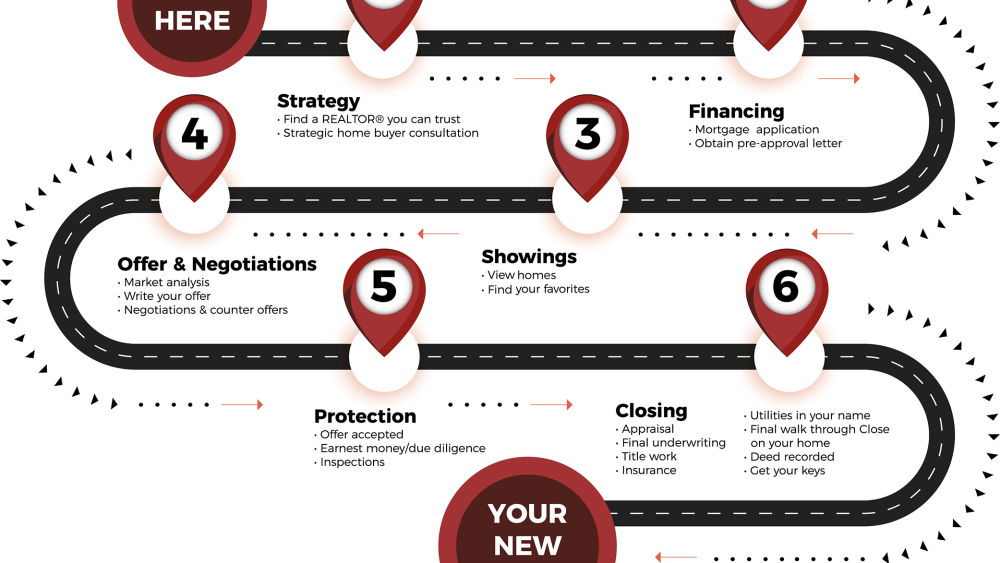

As property values ascend and the pace of the market quickens, being prepared is not just an advantage, it’s a necessity. Here is an essential checklist for you to navigate the twists and turns of home buying with finesse.

Financial Readiness

- Elevate your credit score to a robust 640 or beyond.

- Tailor your budget to your financial inflows and outflows.

- Cultivate a down payment fund, targeting a substantial 20%.

- Approach the loan approval path with fortitude—anticipate its challenges.

Selecting the Ideal Real Estate Agent

- Vet multiple agents to find your perfect match.

- Seek out an agent whose experience and local savvy stand out.

- Ensure they have comprehensive knowledge of your desired locale.

Mortgage Pre-Approval

- Initiate discussions with lenders to gain pre-approval for a mortgage.

- Differentiate between fixed-rate and adjustable-rate mortgage structures.

- Protect your credit score diligently, as it will influence your loan’s interest rate.

| Mortgage Type | Interest Rate | Down Payment | Closing Costs Included |

|---|---|---|---|

| 30-Year Fixed Rate | 3.5% | 20% | Appraisal, Title Insurance, Taxes |

| 15-Year Fixed Rate | 3.0% | 20% | Loan Origination Fee, Credit Report |

| FHA Loan | 3.25% | 3.5% | Mortgage Insurance, Escrow Fees |

Launching the Home Search

- Immerse yourself in open houses and property tours with your agent.

- Compile your list of indispensable features and desirable extras.

- Stay open-minded; the market’s offerings are as diverse as they are plentiful.

Crafting an Offer

- Strategize with your agent to present a persuasive offer.

- Keep in mind the seller’s perspectives and potential countermoves.

- Be nimble in negotiations—they’re a natural part of the home-buying dance.

Inspection and Appraisal

- Commission a thorough home inspection to uncover any hidden quirks.

- Recognize that some character comes with age in homes.

- Use the appraisal to ensure your investment reflects the home’s true worth.

Cementing Your Financing

- Scrutinize the loan estimate and closing disclosure with a keen eye.

- Stay on your toes for any last-minute requests from your lender.

- Cultivate patience; this final stretch will test it.

The Big Day: Closing

- Sign the dotted line with a mixture of enthusiasm and anticipation.

- Prep for the unexpected—it’s all part of the day’s buzz.

- Mark the occasion with your support system who’ve cheered you on.

The Move

- Arm yourself with a comprehensive moving day checklist.

- Decide whether to hire movers or rally your personal troops.

- Savor the milestone; it’s the start of your new chapter.

Beyond the Purchase

- Keep the lines open with your real estate agent for ongoing support.

- Settle into the ebb and flow of homeownership.

- Celebrate your newfound place within your community’s tapestry.

Stepping into homeownership comes with its share of exhilaration and surprises. By sticking to this guide, considering your mortgage choices judiciously, and collaborating with a seasoned real estate agent, you’ll be primed to manage the ebbs and flows of the process. Here’s to your successful homebuying adventure!

Let me know when you’re ready!

Sarah Herda

[email protected]

978-816-8880

Output in